Accenture Outlook Report Highlights: How Brands Can Revive the Physical Store

Last month, Accenture released its outlook report, Online but off track: Rescuing the in-store experience under the premise that despite the rise of digital, retailers can’t ignore the physical store. Instead, they need to “repurpose brick-and-mortar assets as a vital part of the seamless customer experience.”

In recent years, many retailers have focused the core of their efforts in building their online presence and e-commerce sites. They have made shopping online quick and easy, all the while ignoring the 90% of sales that still come from in-store purchases and pushing aside the real experience of shopping.

In an earlier Accenture report on Maximizing Mobile to Increase Revenue, consumers were asked to identify which shopping channel needed the most improvement and found the top answer to be the physical store. The second top answer was the integration of store, online and mobile shopping in to a multichannel experience. Retailers’ focus on “clicks” instead of “bricks” is inadvertently shortchanging the in-store customer experience, and shoppers have noticed.

What shoppers want now is a reconciliation between online and offline shopping, a revival of the physical store with the added benefits of technology. According to the study, here are the primary things shoppers want, with our suggestions for how retailers can deliver:

- They want technology-infused in-store experiences that allow them to access services via their mobile devices before, during and after shopping at the local brick-and-mortar outlet.

- Before: Alongside the e-commerce services already offered, retailers must support online services that allow shoppers to connect directly with stores near them. They should be able to set up appointments with staff, ask pre-visit questions, and check inventory and in-store stock before they enter the store.

- During: Retailers must provide branded devices or in-store Wi-Fi that allows shoppers to interact with products, access digital inventory, and order online while in the store. Arm staff with helpful technology and understandable data tied to a particular shoppers’ preferences and habits so they can perform their jobs easily and provide a more personalized experience for the shopper.

- After: Retailers need to seize the opportunity to re-engage with customers after they’ve left the store using in-store remarketing. They must update online shopper profiles with data collected in-store, keep record of staff who assisted the shopper so the shopper can always connect back with them, and make sure online help services are able to quickly and easily access this information at any point down the line.

- They want retailers to intelligently predict what they want and make it as convenient as possible for them to get the information they need while in the store.

- E-commerce stores are able to show shoppers similar products, items frequently bought together, purchase history, browser history. Shoppers expect this same level of intent prediction in-store.

- For this to work, data collection must occur on both fronts (online and in-store) and must work together to create a cohesive shopper profile.

- Shopper profiles give retailers a big picture view of each customer’s preferences, habits, and history, allowing them to create personalized experiences based on the shopper’s wants and needs.

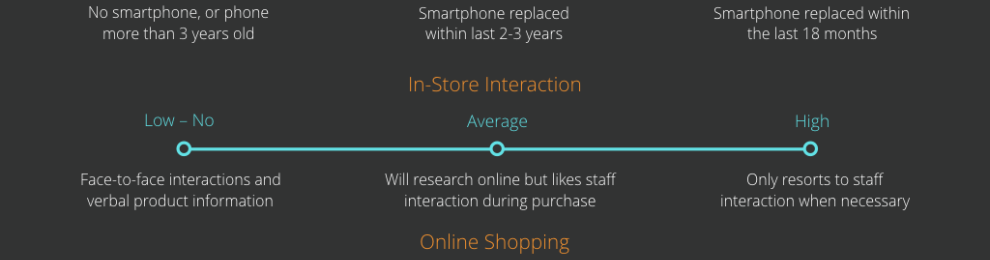

Another great point brought up in the report was using “digital intensity” to map out specific strategies, noting that retailers need to be able to distinguish between customers who are digitally savvy and those who are not. Understanding the digital intensity of their customers lets retailers invest more wisely. But not only that; retailers must also understand the digital intensity of their competitors to make better strategy decisions and target growth more effectively in their market.

The most important takeaway here is the understanding the digital intensity of a brand’s audience is crucial, and this can vary even between stores. An audience with a generally low digital intensity is going to be much less inclined to engage with in-store tech than an audience with a higher digital intensity. When considering the implementation of in-store tech and how it’s used, brands have to consider the digital intensity not only of the brand’s entire audience, but also of the target demographics relative to each branch.

This Accenture Report boils down to one key tenet: the in-store experience is vital to a successful customer experience strategy. Retailers need to take a step back and reconsider brick-and-mortar as the greatest place for meaningful interactions to occur. They need to enhance their stores with digital elements that meld the online and offline, learn to predict and personalize by building complete shopper profiles, and act on the opportunity to re-engage digitally with shoppers in order to truly impact the shopping experience.